Pre-Authorized Checking

As a business owner how many times have you heard, "The check's in the mail."

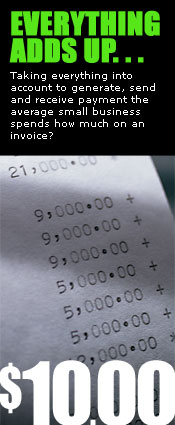

Even with the best intentions, some customers will have difficulty making payments to a business on time. Whether it is because customers cannot afford a large payment, they simply forget to make it, or any other number of excuses the bottom line is this: when a business does not get paid on time it can cause major problems. Poor cash flow is cited as the number one reason why new businesses fail. At this point a business owner has two choices, they can continue to spend a small fortune using traditional methods attempting to collect what their customers owe them, or they can switch over to one of the fastest growing methods for receiving payments today. It is called Pre-Authorized Checking™ (PAC) and now any business owner can start using it immediately to increase their company's bottom line. Even with the best intentions, some customers will have difficulty making payments to a business on time. Whether it is because customers cannot afford a large payment, they simply forget to make it, or any other number of excuses the bottom line is this: when a business does not get paid on time it can cause major problems. Poor cash flow is cited as the number one reason why new businesses fail. At this point a business owner has two choices, they can continue to spend a small fortune using traditional methods attempting to collect what their customers owe them, or they can switch over to one of the fastest growing methods for receiving payments today. It is called Pre-Authorized Checking™ (PAC) and now any business owner can start using it immediately to increase their company's bottom line.

Are these excuses familiar?

- "Your invoice must have gotten lost mail."

- "Did you send me a bill this month?"

- "Can't you draft this from my checking account?"

- "Sorry, I forgot to mail my payment."

- "Let me look at my checkbook, and I will call you right back!"

- "I thought it was due the 15th!"

- "I've been out of town for a couple of weeks."

The reasons for untimely payments could go on and on. The number of customers paying in 30, 60, and 90 days past the due date is increasing. By using PAC, a business can reduce their receivables and help eliminate many of the collection problems before they even occur. PAC also improves customer retention by allowing your customers the option to be on an automated payment system. Studies have shown that consumers who utilize an auto pay system stay with that business in excess of 90% of the time. Business owners using PAC have also found that it helps them attract new customers by using it as an in-house payment or financing plan. This allows their customers to purchase products or services they might not otherwise be able to afford. The best news is that in most cases there are no monthly minimums, no monthly fees, and no on-going cost to the business owner. There is only a small processing fee for drafting each check. This fee can either be included in the customer payment or can be paid by the business at the owner's choice.

Here Is How It Works:

PAC ensures that your payments are received on time each month, every month. A customer simply completes the release form to sign up for the program. This form is then forwarded along with other completed forms to Now Business Solutions. Our processing center prints the pre-authorized checks for the agreed upon amounts and delivers them to the business on the scheduled date(s). Owners simply take the pre-authorized checks to their banks and deposit them like any normal check. Depending on the volume of accounts, Now Business Solutions can even deposit the checks for a business.

With PAC there is no computer access into a customer's checking account like a traditional ACH. Their check is simply re-created on the agreed-upon day each month for deposit into the business owner's bank account. Their pre-authorized check is noted on their monthly bank statement like any other check. This non-threatening approach makes signing up customers on PAC very easy. Since you will be in control of the checks being deposited, there is no chance for the bank to make a mistake on your customer's account. This flexibility allows you to even hold a check for a few days if necessary for your customer without any problems or fees.

There is no cost for software, hardware, phone lines, or any of the typical expenses required for electronic fund transfers by the bank.

Considering convenience, cost efficiency and excellent service, PAC is rapidly becoming one of the nation's leading methods of automatic payment processing. Major retail, utility, mortgage companies, and insurance companies have utilized this system for over 20 years! Now Now Business Solutions can make it available to any business regardless of its size.

Make sure to contact us today to speak with a representative regarding this amazing new service!

|